2. Do a one time Virtual Terminal Authorize and Capture to make up for the credit card transaction that just failed.

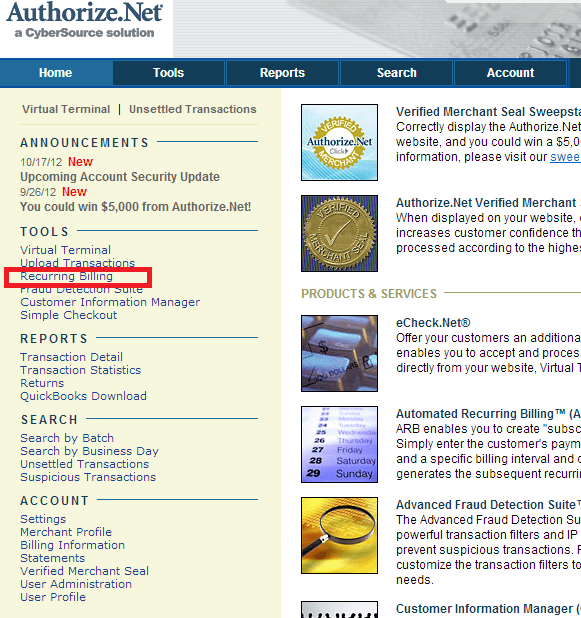

- After you’ve logged into your Authorize.net account, select Recurring Billing from the Tools Menu on the left hand side.

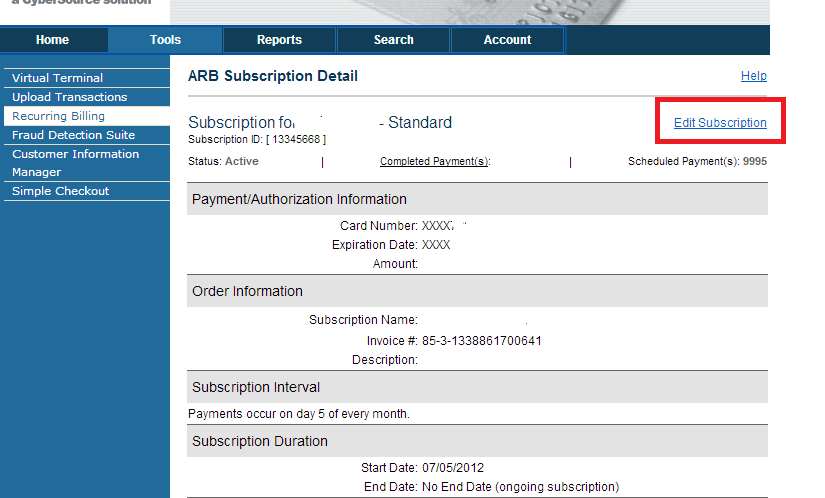

- Select the subscription that failed. On the ARB Subscription Detail, click on the Edit Subscription.

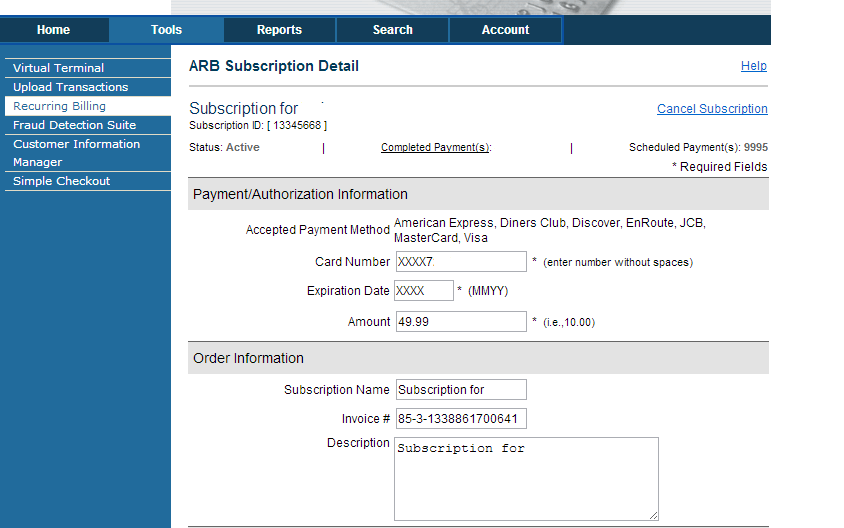

- Enter the new credit card information. Submit the information

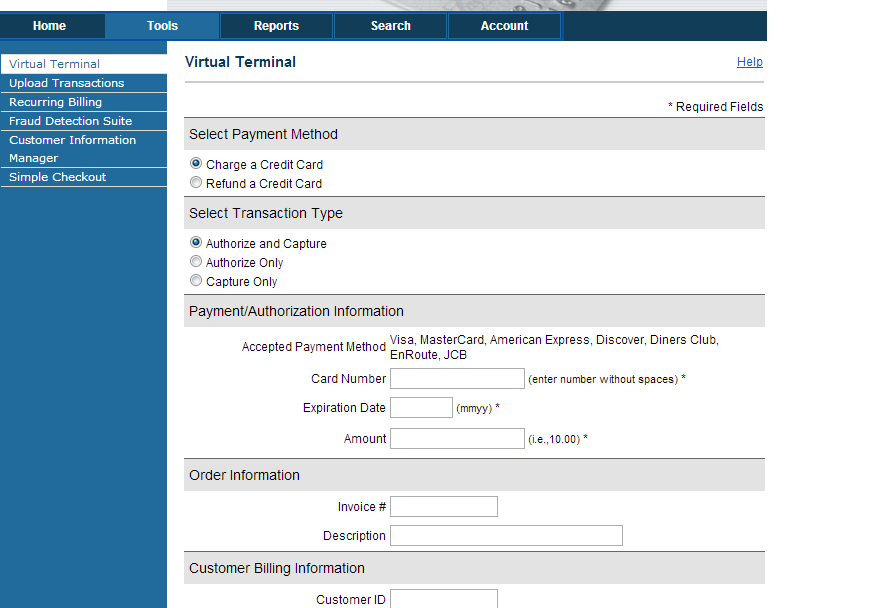

- Return to https://account.authorize.net/

- Go to Virtual Terminal from the Tools Menu

- Do a Authorize and Capture on the new credit card.

- Congrats! You’ve now successfully updated your client’s credit card information so you can continue to collect money via their existing subscription.

Joel Garcia has been building AllCode since 2015. He’s an innovative, hands-on executive with a proven record of designing, developing, and operating Software-as-a-Service (SaaS), mobile, and desktop solutions. Joel has expertise in HealthTech, VoIP, and cloud-based solutions. Joel has experience scaling multiple start-ups for successful exits to IMS Health and Golden Gate Capital, as well as working at mature, industry-leading software companies. He’s held executive engineering positions in San Francisco at TidalWave, LittleCast, Self Health Network, LiveVox acquired by Golden Gate Capital, and Med-Vantage acquired by IMS Health.