Understanding the Revolution of Decentralized Finance (DeFi)

DeFi (Quick Explanation):

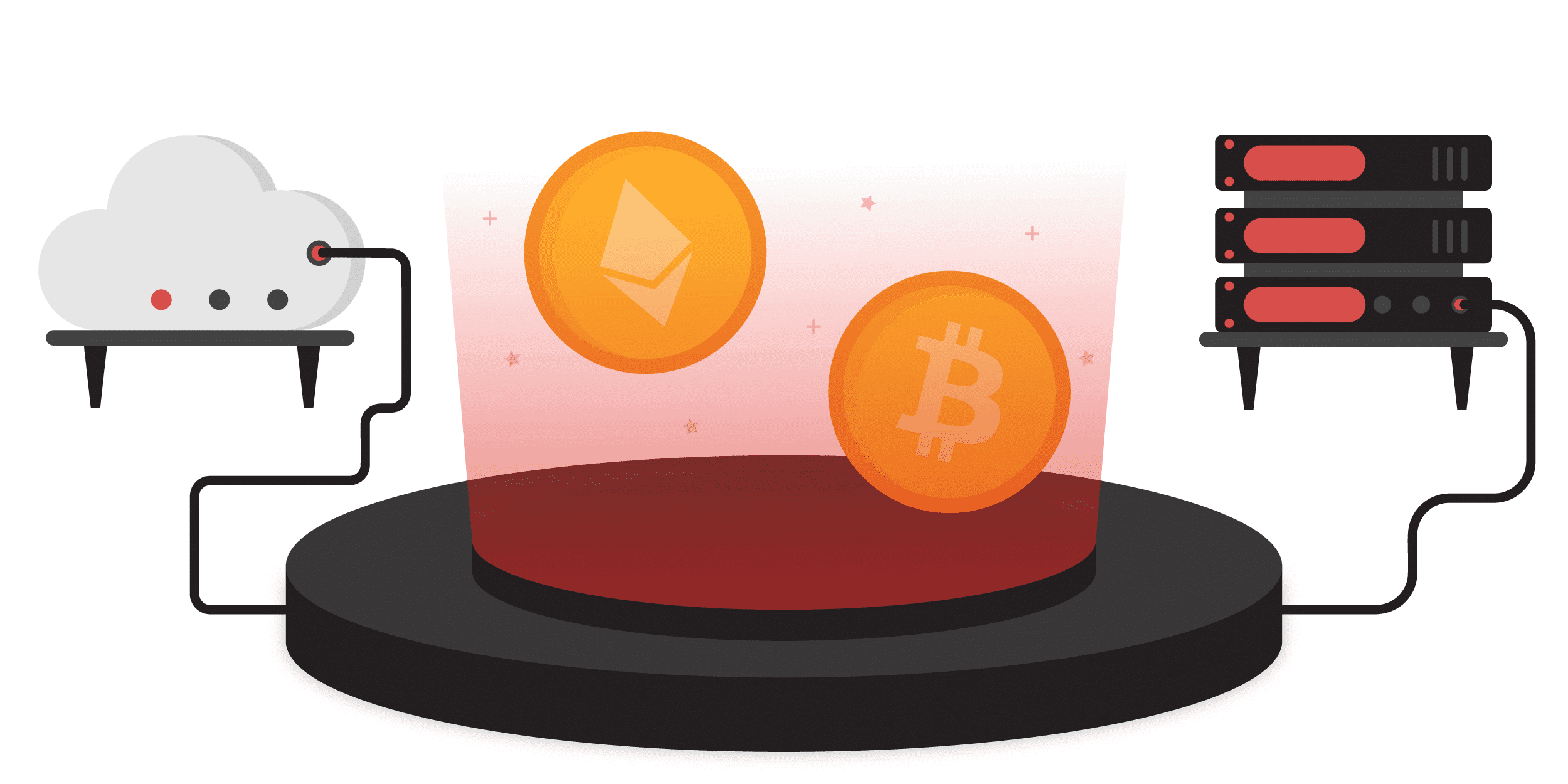

Decentralized Finance (DeFi) integrates cryptocurrencies like Bitcoin with blockchain technology services such as Uniswap in order to deliver permissionless financial services.

The buzz around DeFi in the blockchain realm has intensified thanks to its ability to grant access to financial services independent of one’s geographical, social, or infrastructural parameters — all you need is an internet-enabled device.

How is DeFi broadening the definition of banking across the globe? Through blockchain technology!

Blockchain verifies peer-to-peer cryptocurrency transactions and records the information across distributed ledgers. Companies can implement blockchain technology to offer customers decentralized services on their platforms.

Key Takeaways:

• Blockchain technology is not controlled by a single entity.

• Deficiencies in the current financial system have moved people to create a new monetary system.

• DeFi aims to empower the user by making finance universal.

What is centralized banking?

Before we further explore DeFi, a general understanding of centralized finance will help us to grasp the appeal and need for the new monetary concept.

Centralized banking, which oversees the commercial banking system, is the high-level management of a state’s formal, regulated finances. In the United States, the Federal Reserve, called “the men in suits” by skeptics, manages the nation’s monetary policy.

“Top-down” decision making by elite executives has led to the popular perception of it being flaw-ridden and fragile. No wonder the unique advantages of decentralized finance are in such keen focus among high-tech’s brightest minds and deepest pockets. DeFi promises to be an alternative global financial system with practical solutions in the near future.

Did you know?

According to the Federal Financial Institutions Examination Council, between 1984 and 2019, the number of commercial banks in the U.S. dropped from 14,400 to 4,492. This has resulted in the concentration of resources among a select group while simultaneously reducing the level of access to responsive, customer-oriented financial services.

What is DeFi?

Decentralized finance, or open finance, is the delivery of monetary services on a blockchain. DeFi, like FinTech, aims to put traditional financial services — lending, savings, stocks, insurance and more — in the hands of anyone with a smartphone; minus the monetary thresholds and segregated currencies.

Cryptocurrency is at the core of DeFi’s global recognition, fueling the widespread adoption of Bitcoin, Ethereum, and other border-resistant digital assets. Cryptocurrency is secured by cryptographic technology, which requires that each transaction be verified. This eliminates the waste and fraud so prevalent in traditional banking.

Did you know?

Coinbase, the world’s most popular cryptocurrency trading app, houses over 30 million unique users and is getting bigger by the day.

Examples of DeFi

Companies are in a foot race to deliver the peerless decentralized solutions that will supplant the global banking system.

DApps

Decentralized applications (DApps) play a fundamental role in the emergence of DeFi technology. These non-authoritative applications run on blockchain technology and can operate autonomously, making them cease-resilient.

Decentralized Exchanges

Decentralized exchanges let you maintain complete access over your assets and don’t hold login information in their servers. Centralized exchanges store your keys and other private information in their server, leaving your assets exposed in the chance of a hack.

Did you know?

98% of all DApp volume is controlled between Ethereum, Tron, and EOS. Also, $6.396 Billion in total value is locked into DeFi.

Key components of DeFi

Open-Source

Decentralized technology is open-source, meaning that anybody can use the code and build the same project or build on top; the future is restricted only by your imagination.

Transparency

The code is located on the blockchain for anybody to audit, inherently building trust among its users. All transactions are viewable from the blockchain, but not linked to real-life identities.

Permissionless

There are no restrictions on who can build or use DeFi apps — they’re entirely open-source and there’s no tedious paperwork required.

Interoperability

Custom DeFi applications can be constructed or composed by integrating other projects into super solutions.

Related Article

How FinTech is Shaping the World Around us

A self-motivated digital marketing specialist with 3+ years of experience advertising in the financial services industry.

While I wear several marketing hats, my primary focus is on content strategy and curation.

I aim to consistently challenge myself and position my skills toward personal and professional endeavors that lead to measurable results.